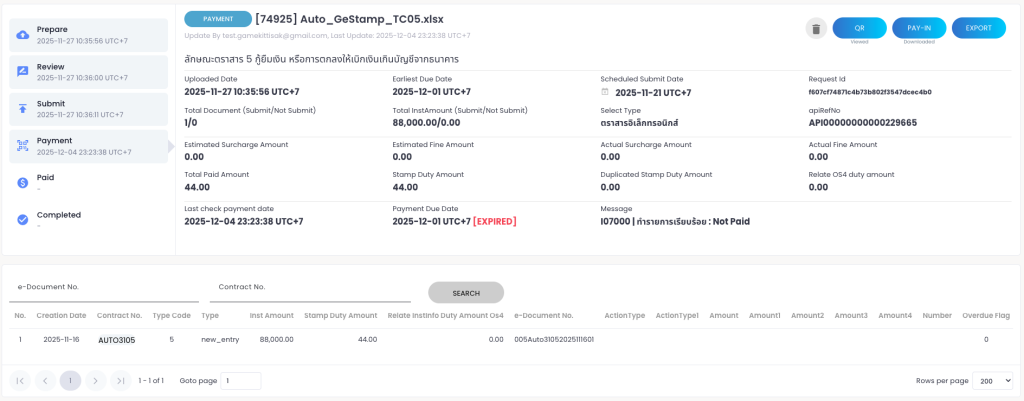

This section displays all stamp duty payment requests included in the selected batch. It includes summary information such as the total number of items, stamp duty amount, surcharge, penalty, and relevant dates, as well as any error messages that occurred. These messages are intended to inform the Preparer to make corrections before submitting the batch to the Approver for review.

Information on Batch Detail Screen #

| Data Field | Description |

|---|---|

| File Name | Displays the Batch Number and the name of the uploaded file. |

| Uploaded Date | Displays the data upload date. |

| Earliest Due Date | Displays the earliest due date in the batch (Due Date Calculation Method): – If based on creationDate, calculate: creationDate + 15 – If receiveDate is specified, calculate: receiveDate + 15 |

| Scheduled Submit Date | Displays the scheduled due date based on the submission cycle. – ถ้าผู้ใช้งานเลือกให้ batch ตั้งเวลาส่งข้อมูล จะแสดงปฎิทินสีเขียว – ถ้าไม่ใช่จะแสดงปฏิทินสีเทา |

| Request Id | Displays the request ID generated by the system to be sent to the Revenue Department. |

| Total Document | Displays the number of instruments. |

| Total Inst Amount | Displays the total contract amount. |

| Select Type | Displays the instrument type. |

| apiRefNo | Displays the reference code received from the Revenue Department after submitting the data. |

| Estimated Surcharge Amount | Displays the estimated surcharge amount calculated by the system. |

| Estimated Fine Amount | Displays the estimated fine amount calculated by the system. |

| Actual Surcharge Amount | Displays the total surcharge amount returned by the Revenue Department after submission. |

| Actual Fine Amount | Displays the total fine amount returned by the Revenue Department after submission. |

| Total Paid Amount | Displays the total stamp duty amount, calculated as: Stamp Duty Amount + Duplicated Stamp Duty Amount + Actual Surcharge Amount + Actual Fine Amount + |

| Stamp Duty Amount | Displays the stamp duty amount. |

| Duplicated Stamp Duty Amount | Displays the duplicated stamp duty amount. |

| Relate OS4 duty amount | แสดงมูลค่าอากรแสตมป์ที่อ้างอิงจาก Paper stamp duty |

| Prepare Date | Displays the data upload date. |

| Channel | Displays the data upload channel. |

| Upload By | Displays the user who uploaded the data. |

| Review Date | Displays the data review date. |

| Review Message | Displays the review comments. |

| Submit Date | Displays the date the data was submitted to the Revenue Department. |

| Submit Message | Displays the data submission status. |

| Last check payment date | Displays the latest date the payment status was checked. |

| Payment Due Date | Displays the payment due date. |

| Payment Message | Displays the payment status. |

| Paid Date | Displays the date the Revenue Department received the payment. |

| Paid Message | Displays the payment status. |

| Completed Date | Displays the date all receipts were successfully received. |

| Completed Message | Displays the transaction processing status. |

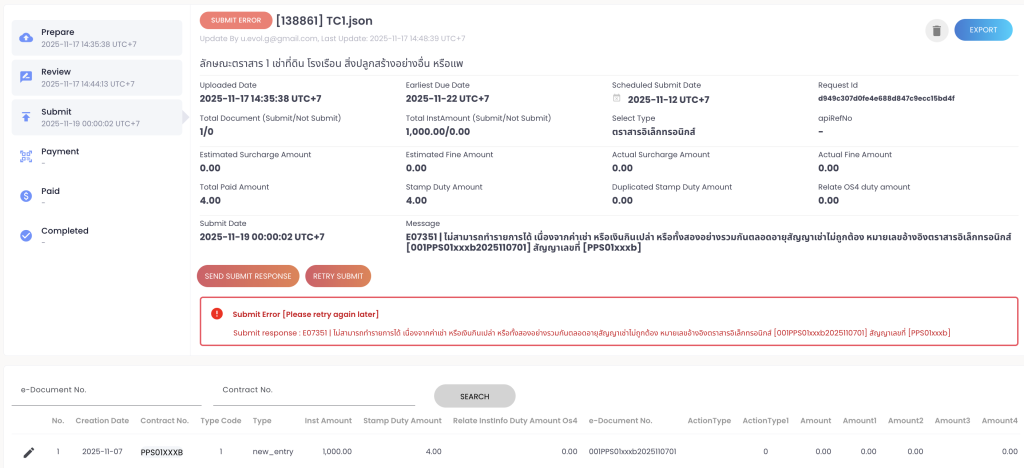

Record Error Message #

- Input Error Displays detailed errors detected by the system from the imported data. All erroneous records will be listed with reference to the line number from the original file.

- Submit Error, Filing Error, Payment Error and Receipt Error Displays the error details received from the Revenue Department’s e-Stamp Duty system.

The Batch Detail screen displays a table of stamp duty submission data with the following details: #

| Column | Description |

|---|---|

| No. | Instrument Import Order |

| Creation Date | Contract Creation Date / Credit Line Setup Date / Additional Credit Line Date (YYYY-MM-DD) |

| Contract No. | Contract Number |

| Contract Party First Name | First Name of the Contracting Party |

| Contract Party Last Name | Last Name of the Contracting Party |

| Contract Amount | Instrument Amount (Excl. VAT) |

| Stamp Duty Amount | Stamp Duty Amount ในกรณีที่ข้อมูลรายการใดคำนวณได้ค่าอากรเท่ากับ 0 ระบบจะแสดงสีพื้นหลังของรายการนั้นเป็นสีเทาอ่อน และรายการนั้นจะไม่ถูกส่งไปกรมสรรพากร เนื่องจากกรมสรรพากรไม่รับข้อมูลรายการที่ไม่ต้องเสียค่าอากร |

| Duplicated Stamp Duty Amount | Duplicate Stamp Duty Amount |

| Total Paid Amount | Total Stamp Duty Amount (Including Duplicates) |

| e-Document No. | E-Document Reference Number Format |

| Estimated Surcharge Amount | Surcharge |

| Estimated Fine Amount | Fine |

| Actual Surcharge Amount | Surcharge from RD System after Submission |

| Actual Fine Amount | Fine from RD System after Submission |

| Total Amount | Total Amount Payable (Duty + Surcharge + Fine) |

| Previous Submit | Previous Stamp Duty Submission Type Electronic = Form OrSor.9 Paper = Form OrSor.4 |

| Entity Id | Sender Code |

| Sender Role | Sender Role 1 = Direct Taxpayer 2 = Service Provider |

| Form Type | Form Type (AS9 or OS9) |

| Select Type | Instrument type code 0 = Electronic 1 = Non-Electronic |

| Type Code | Instrument Type |

| UserId | Import Data Email |

| Effective Date | Contract Creation Date |

| Expire Date | Contract Expire Date |

| Receive Date | Electronic Instrument Receipt Date For foreign-origin instruments submitted in Thailand |

| Send Form Type | Send Form Type 1 = New Entry 2 = Additional (for an existing contract) |

| Type | Submission Type – Both Initial and Contract Modification Submissions" - new_entry: Initial submission - increase_limit: Increase of contract amount (as an appendix to the original contract) - additional: Additional submission to pay the shortfall |

| Filing No. | Additional Submission Count 0 = Regular n = Additional submission time n |

| Overdue Flag | Submission Timing Type 0 = On time 1 = Overdue - If specified in input file, the system uses it. - If not, system calculates. |

| DupNumber | Number of Duplicate Instruments |

| TaxPayer | Taxpayer Identification Number (TIN) of Submitter |

| Brach No. | Branch Number |

| Branch Type | Branch Type V = VAT or both VAT & SBT S = SBT only O = Not VAT/SBT registered |

| Relationship | Relation to Contract |

| Contract Party Tax ID | Counterparty Taxpayer ID |

| Contract Party Branch No | Counterparty Branch Number |

| Contract Party Branch Type | Counterparty Branch Type V = VAT or both VAT & SBT S = SBT only O = Not VAT/SBT registered |

| Building Name | Building Name |

| Room No. | Room Number |

| Floor No. | Floor Number |

| Village Name | Village Name |

| Building Number | Building Number |

| Moo | Moo |

| Soi | Soi |

| Junction | Junction |

| Street | Street |

| District | District |

| Province | Province |

| Postcode | Post Code |

| Country Id | Country Code 2 digits |

| Total Party | Number of Counterparties (Click to view all counterparties) |

| Total Relate Contract | Number of Related Parties to the Contract (Click to view all related parties) |

| Array Detail | Details (Click to view all details) |

| Relate InstInfo Id | Original Electronic Document Reference Number - If specified in input file, the system uses it. - If not, system calculates. |

| Relate InstInfo Contract No. | Original Contract Number - If specified in input file, the system uses it. - If not, system calculates. |

| Relate InstInfo Creation Date | Original Contract Creation Date - If specified in input file, the system uses it. - If not, system calculates. |

| Relate InstInfo Duty Amount Os4 | Previous Paid Stamp Duty Form OrSor.4 |

| Detail1 | Instrument Additional Detail 1 |

| Detail2 | Instrument Additional Detail 2 |

| Detail3 | Instrument Additional Detail 3 |

| Detail4 | Instrument Additional Detail 4 |

| Detail5 | Instrument Additional Detail 5 |

| Detail6 | Instrument Additional Detail 6 |

| Detail7 | Instrument Additional Detail 7 |

| Detail8 | Instrument Additional Detail 8 |

| Date | Meeting Date |

| Amount | Guarantee Amount (from contract) |

| Amount1 | Contract Related Amounts 1 |

| Amount2 | Contract Related Amounts 2 |

| Amount3 | Contract Related Amounts 3 |

| Amount4 | Contract Related Amounts 4 |

| Number | Other Related Amount |

| Action Type | Contract Conditions |

| actionType1 | Contract Conditions 2 |

| Counterparty Email | |

| Product Code | Product Code (from source system) |

| Old Limit | Original Instrument Amount |

| Issue Number | Number of Copies |

| Foreign Type | Foreign Type 0 = Thai 1 = Non-Thai |

| Reserve1 | Reserve field 1 |

| Reserve2 | Reserve field 2 |

| Reserve3 | Reserve field 3 |

| Reserve4 | Reserve field 4 |

| Reserve5 | Reserve field 5 |

Counterparty Information (Relate Party) #

| Column | Descripition |

|---|---|

| Related Party Id | Taxpayer Identification Number of the Counterparty |

| Related Party Title | Title of the Counterparty |

| Related Party Name | First Name of the Counterparty |

| Relate Party SurName | Last Name of the Counterparty |

| Relate Party Branch No. | Branch Number |

| Related Party Branch Type | Branch Type V = VAT or both VAT & SBT S = SBT only O = Not VAT/SBT registered |

Related Contract Parties Information (Relate Contract) #

| Column | Descripition |

|---|---|

| Related Contract Id | Taxpayer Identification Number of the Related Contract Party |

| Related Contract Title | Title of the Related Contract Party |

| Related Contract Name | First Name of the Related Contract Party |

| Relate Contract SurName | Last Name of the Related Contract Party |

| Relate Contract Branch No. | Branch Number |

| Related Contract Branch Type | Branch Type V = VAT or both VAT & SBT S = SBT only O = Not VAT/SBT registered |

Array Detail information #

| Column | Description |

|---|---|

| Type | Instrument 1: 1 = Details of Leased Property 2 = Details of Rental or Estimated Rental Instrument 3: 1 = Details of Leased Asset 2 = Details of Movable Property |

| Action Type1 | Instrument 1: Type of Leased Property: 1 = Land 2 = Building 3 = Other Construction 4 = แพ Type of Rental or Estimated Rental: 1 = Monthly Rental Payment 2 = Annual Rental Payment 3 = Variable Rental 4 = Lump-sum Rental for Contract Term Instrument 3: Type of Leased Asset: 1 = Land 2 = Building 3 = Other Construction Type of Movable Property: 1 = New Car 2 = Used Car 3 = New Motorcycle 4 = Used Motorcycle 5 = Others |

| Action Type2 | Instrument 1 and 3: If Action Type1 = 1 (Land): 1 = Land Title Deed 2 = NorSor 3 3 = NorSor 3a 4 = NorSor 3b 5 = Other Land Documents If Action Type1 = 2 (Building): 1 = Residential Building 2 = Commercial Building 3 = Townhouse 4 = Condominium 5 = Office Building 6 = Others |

| Detail 1 | Instrument 1: Land No., Building No., Construction No., Raft No., or Rental Estimate Details (as applicable) Instrument 3: Land No., Building No., Construction No., or Brand (as applicable) |

| Detail 2 | Instrument 1: Subdistrict Name Instrument 3: Subdistrict Name or Model (as applicable) |

| Detail 3 | Instrument 1: District Name Instrument 3: District Name, or Registration Number / Serial Number (as applicable) |

| Detail 4 | Instrument 1: Province Name Instrument 3: Province Name, Engine Number, or Property Type (as applicable) |

| Detail 5 | Instrument 1: Other Construction, Type of Land Document, Condominium Name, or Other Building Type (as applicable) Instrument 3: Other Construction, Type of Land Document, Condominium Name, Building Type, Vehicle Chassis Number, or Others (as applicable) |

| Detail 6 | Instrument 1: Land Title Deed No., Nor Sor 3 No., Nor Sor 3 Kor No., Nor Sor 3 Khor No., or Other Land Document No. (as applicable) Instrument 3: Same as Instrument 1 or Color (as applicable) |

| Amount 1 | Instrument 1: Monthly Rental, Annual Rental, Variable Rental Estimate, or Lump-sum Contract Rental (as applicable) |

| Amount 2 | Instrument 1: Key Money (One-time payment to lessor) |

| Amount 3 | Instrument 1: Total Amount |

| Number 1 | Instrument 1: Number of Months or Years (as applicable) |

Action Button #

Refers to the button(s) that allow users to perform specific actions within the system. The available actions vary depending on the status of each Batch, and may include options. Here are the details of the Action Buttons.

| Batch Status | Action Button |

|---|---|

| Preparing | Trash, Submit for Review, Export |

| Reviewing | Trash, Reject, Submit, Schedule Submit, Export |

| Rejected | Trash, Import Fixes, Export Fixes, Export |

| Payment | Trash, Check Payment, QR, Pay-in, Send Payment Response, Export |

| Paid | Get Receipts, Export |

| Completed | Get Receipts, Receipts, Export |

| Input Error | Trash, Edit, Import Fixes, Export Fixes |

| Submit Error | Trash, Retry Submit, Send Submit Response, Export |

| Filing Error | Trash, Retry Submit, Check Filing, Send Submit Response, Export |

| Payment Error | Trash, Check Payment, Send Payment Response, Export |

| Receipt Error | Get Receipts, Export |

Functions of the Action Buttons #

| Action Button | Button | Action |

|---|---|---|

| Trash | Used to delete the batch, including all stamp duty payment request data within the batch. | |

| Submit for Review | Used to submit the batch to the Approver for review. | |

| Import Fixes | Used to re-import the corrected data into the system from the Batch Detail screen. | |

| Edit | Used to edit the data directly via the system interface. | |

| Export Fixes | Used to export data for editing, which can then be re-imported into the original batch. | |

| Retry Submit | Used to reattempt connection with the Revenue Department's system due to a previous connection failure. | |

| Reject | Used to return the batch to the Preparer for data correction. The Approver can specify reasons for the revision. | |

| Submit | Used to submit the stamp duty payment request data to the Revenue Department. | |

| Schedule Submit | Used to schedule the submission of data to the Revenue Department. | |

| QR | Used to download the QR Payment for payment processing. | |

| Pay-in | Used to download the Pay-in Slip for payment processing. | |

| Receipts | Used to download the payment evidence as a zip file. When unzipped, the file will contain the following documents: – The receipt will be issued in the name of the responsible taxpayer. – The electronic stamp duty payment request form for electronic instruments, or Form OrSor9. – The stamp duty payment certification code in QR Code format. | |

| Check Payment | Used to request the system to re-verify the payment information with the Revenue Department’s system. | |

| Get Receipts | Used to request the system to retrieve the receipt documents again from the Revenue Department’s system. | |

| Send Submit Responese | Used to resend the submit response file to the customer as previously configured. | |

| Send Payment Response | Used to resend the payment response file to the customer as previously configured. | |

| Export | ใช้ export ข้อมูลตราสารทั้งหมดใน batch นั้นออกมาเป็นไฟล์ csv |

e-Stamp Duty History #

View stamp duty purchase history for the same contract number by clicking the contract number on the Bath Detail screen

การแก้ไขข้อมูลตราสาร #

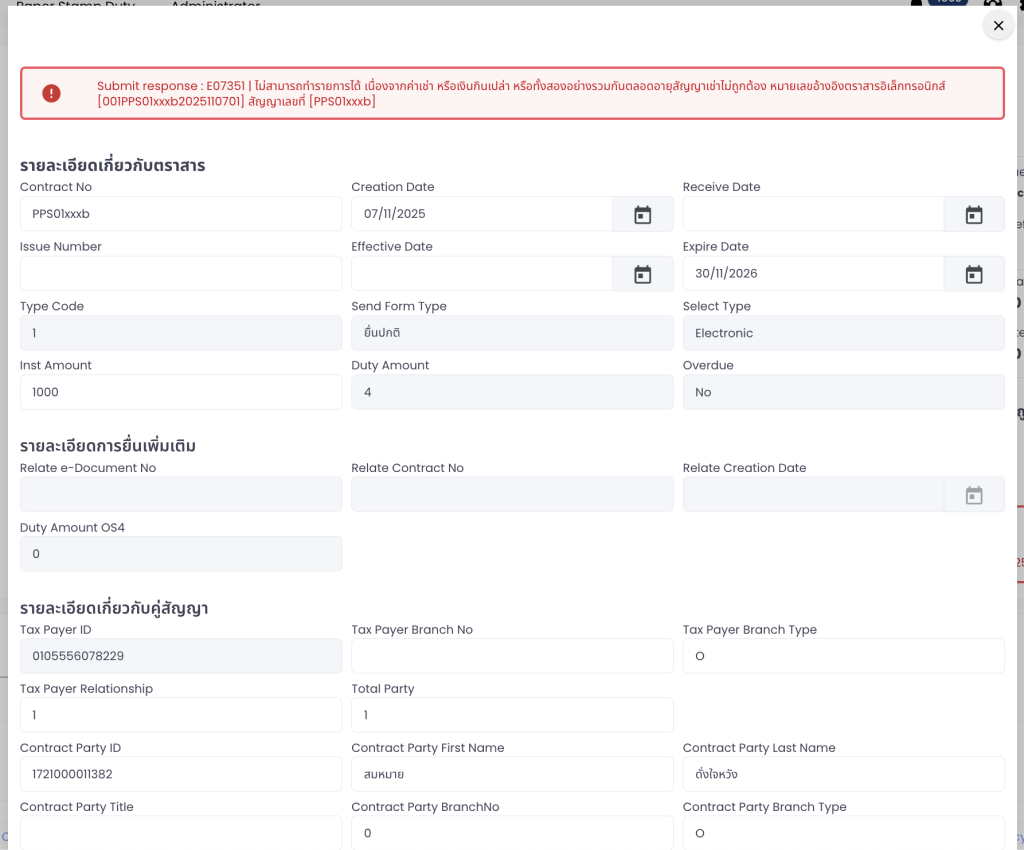

ผู้ใช้สามารถแก้ไขข้อมูลรายตราสารได้ ในกรณีที่ได้รับข้อความ error จากกรมสรรพากร ซึ่งจะเกิดได้กับสถานะของ batch ใน 2 กรณี คือ “Submit Error” และ “Filing Error” ในกรณีที่ข้อความ Error ที่ได้รับจากกรมมีการระบุถึงเลขที่สัญญาหรือหมายเลขอ้างอิงตราสารอิเล็กทรอนิกส์ ให้แสดงปุ่ม edit หน้ารายการที่เลขที่สัญญาตรงกับ message เพียงรายการเดียว หากข้อความไม่ระบุตราสารมาให้ ระบบจะแสดงปุ่ม edit ทุกรายการ

ตัวอย่าง Error massage ที่ได้จากกรมที่สามารถอ่านเลขที่สัญญาหรือหมายเลขอ้างอิงตราสารฯ ได้ “หมายเลขอ้างอิงตราสารอิเล็กทรอนิกส์

[005GSD-442_TC5_092025110307] สัญญาเลขที่ [GSD-442_TC5_09]”

รายละเอียดหน้าจอแก้ไขข้อมูลตราสาร #