Easy to manage

E-Stamp Duty.

E-STAMP DUTY SOLUTION

GeStamp Duty คือ ระบบที่ช่วยบริหารข้อมูลขอเสียอากรแสตมป์เป็นตัวเงินสำหรับตราสารอิเล็กทรอนิกส์ (อส.9) และตราสารกระดาษ (อส.4, อส.4ก, อส.4ข) บนระบบออนไลน์

ช่วยให้คุณทำงานออนไลน์ได้ครบ จบในที่เดียว: ส่งข้อมูล, ตรวจสอบ และดาวน์โหลดใบเสร็จอย่างปลอดภัย

Ginkgo Soft Co.,Ltd.

The information system has been certified under the name of...

“GeStamp Duty” To act as a service provider on behalf of clients for the preparation and submission of monetary stamp duty payments, in accordance with the standard guideline on the provision of services for the creation, submission, or storage of electronic data (ขมธอ. 35-2567). First!!!

We are dedicated to enhancing our application and services to support fast, secure, and paperless operations for all users.

GESTAMP DUTY SOLUTION

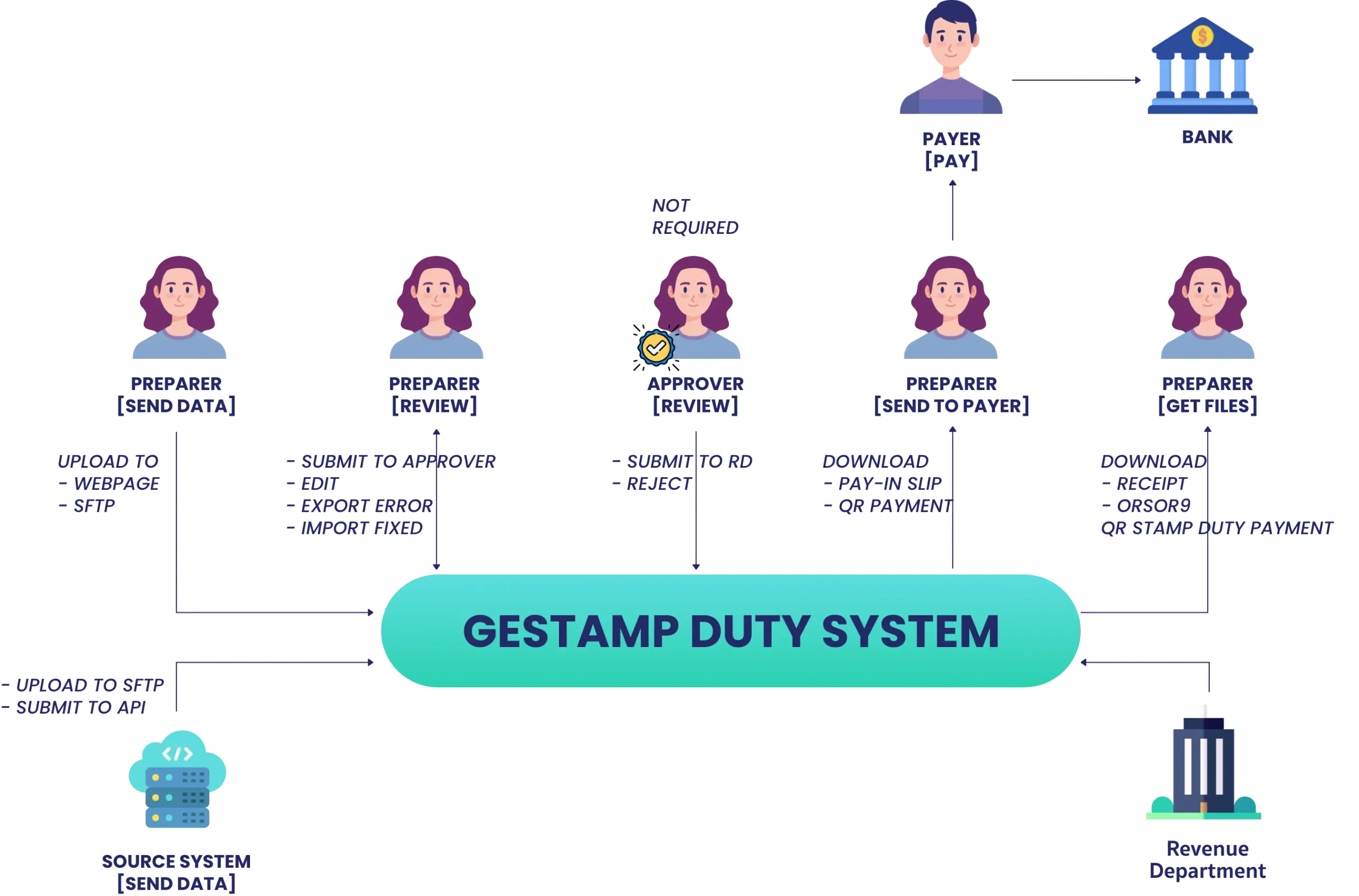

e-Stamp Duty process

Stamp duty payers are required to complete only 4 steps.

- Submit the e-stamp duty data to the GeStamp Duty system. (1)

- Download the payment files (Pay-in slip, QR payment). (4)

- Make the e-stamp duty payment using any convenient payment method. (5)

- Download the e-stamp duty payment receipt from the GeStamp Duty system. (9)

Working Step

GESTAMP DUTY SOLUTION

Release Note

version 2.0 : January 25, 2026

ระบบ GeStamp Duty ได้รับการอัปเดตเพื่อรองรับการทำงานตามข้อกำหนดล่าสุดของกรมสรรพากร โดยเพิ่มการรองรับการส่งข้อมูลด้วย version 01.02.0000 พร้อมทั้งยังสามารถเลือกใช้งานได้ทั้ง version 01.01.0002 และ 01.02.0000

ระบบรองรับการส่งข้อมูลตราสารกระดาษ (selectType = 1) โดยสามารถนำเข้าข้อมูลที่มีหลายประเภทปะปนกันได้ ระบบจะคัดแยกข้อมูลอัตโนมัติตาม selectType, typeCode และช่วงเวลาการ submit ของแบบ OS4A และ OS4B ช่วยลดขั้นตอนการจัดการข้อมูลและลดความผิดพลาดในการส่งข้อมูล

เปิดให้ผู้ใช้งานสามารถระบุค่าอากรและค่าอากรคู่ฉบับเองได้ นอกจากนี้ ยังมีการปรับปรุงการแสดงผลหน้าจอและการจัดการไฟล์ชุดใบเสร็จ เพื่อเพิ่มความสะดวกและประสิทธิภาพในการใช้งานระบบโดยรวม

The GeStamp Duty system has been updated to support the latest requirements of the Revenue Department, including data submission using version 01.02.0000. The system also continues to support version 01.01.0002.

The system now supports submission of paper instruments (selectType = 1). Users can import mixed data, and the system will automatically classify records based on selectType, typeCode, and the submission period for OS4A and OS4B forms, reducing manual effort and submission errors.

Enhancements also include the ability for users to manually enter stamp duty and duplicate duty amounts. User interface improvements and enhanced receipt file management further improve system usability and efficiency.

Monetary stamp duty payments for electronic instruments can be submitted online via the API service

provided by the Revenue Department. At present, the system supports 27 types of instruments, as listed below:

Instrument 1: Lease of land, buildings, other structures, or rafts

Instrument 2: Transfer of share certificates, debentures, bonds, or debt certificates issued by companies, associations, partnerships, or any organizations

Instrument 3: Hire-purchase of property

Instrument 4: Contract for work or manufacturing (work-for-hire agreement)

Instrument 5: Loan agreement or overdraft arrangement with a bank

Instrument 6: Insurance policy

Instrument 7: Power of attorney

Instrument 8: Proxy for voting in company meetings

Instrument 9(1): Bill of exchange

Instrument 9(2): Promissory note

Instrument 10: Bill of lading

Instrument 11(1): Share certificates, debentures, or debt certificates issued by companies, associations, partnerships, or any organizations

Instrument 11(2): Government bonds of any government sold in Thailand

Instrument 12: Cheque or any order used in lieu of a cheque

Instrument 13: Deposit receipt

Instrument 14: Letter of credit

Instrument 15: Traveler's cheque

Instrument 16: Delivery order

Instrument 17: Guarantee agreement

Instrument 18: Pledge agreement

Instrument 19: Warehouse receipt

Instrument 20: Order to deliver goods

Instrument 21: Agency agreement

Instrument 23: Duplicates or counterparts of instruments

Instrument 27(a): Partnership agreement

Instrument 27(b): Amendment to partnership agreement

Instrument 28(c): Receipt for sale, hire-purchase, conditional sale, or transfer of ownership of vehicles required to be registered

e-Stamp duty ?

What is the term 'electronic instrument'?

An instrument under the stamp duty rate schedule that is created as electronic data in accordance with the Electronic Transactions Act.

Stamp Duty Payment Certification Code

A code issued by the Revenue Department to the taxpayer upon receipt of stamp duty payment, used for verifying key information related to the electronic instrument.

Verify e-stamp duty payment certification code

Who is the recipient named on the receipt?

The person submitting a monetary stamp duty payment request for an electronic instrument must be a contracting party to the instrument (agreement). The receipt will be issued in the name of the party specified in the instrument data submitted to the system. For example, in a contract for work under the stamp duty schedule, the duty is to be paid by the contractor. However, if the employer (hirer) purchases the stamp duty and is listed as the buyer in the submission, the receipt will be issued in the employer's name.

When is an electronic instrument considered fully stamped?

Once the Revenue Department has issued the receipt and the Stamp Duty Certification Code, the taxpayer is required to reference or attach the certification code to the electronic instrument.

Import and Validate Data

- You can import multiple records at a time by...

- Place the file in the FTP folder or the zDOX system.

- Upload file on the web application

- submit file via API

- The system supports three types of file imports: .xlsx, .csv, .json

- The system is capable of automatically calculating the stamp duty prior to submission.

- The system can automatically calculate the stamp duty before submission.

- The system is capable of automatically identifying overdue stamp duty payment items and calculating applicable surcharges and fines.

Submit & Schedule Submit

- The system supports stamp duty payment submissions containing either fewer than or more than 50 items.

- When an imported file contains a large volume of records, the system automatically divides the file, as the Revenue Department restricts each submission of stamp duty payment requests to a maximum of 1,000 records.

- The system allows for immediate submission of records to the Revenue Department or scheduling of submissions based on the earliest due date among the records in the file to set the submission time.

Other e-stamp duty features

- Monetary stamp duty payments can be requested for 27 types of electronic instruments.

- Compatible with the latest version of the Revenue Department's system.

- Invalid data can be exported from the system in Excel format for correction, and the corrected file can then be re-imported into the system.

- Data can be edited directly from the system interface, with invalid entries highlighted and the reasons for errors displayed.

- The system allows assigning reviewers and approvers for records.

- Monetary stamp duty payment requests can be imported using Form Or.Sor.4 for reference in additional submissions

- There are three types of system users:

- Preparer

- Approver

- Company Administrator

- The system allows the assignment of multiple affiliated companies; however, subsidiaries under these companies cannot be assigned.

- The Company Administrator is responsible for creating user accounts and assigning user permissions.

- Preparers and Approvers can only access data of affiliated companies to which they have been granted permission.

- Multiple additional monetary stamp duty payment requests can be submitted.

- Additional requests can be made for previous items submitted using either Form Or.Sor.9 or Form Or.Sor.4."

e-Stamp duty Benefits

SAVE

Save time and costs in document preparation and delivery.

CONVENIENT

Convenient and reduces the time required to search for documents.

CALCULATE

Reduce errors in tax calculation.

INFORM

Provides information on the final date for submitting stamp duty payment requests.

VALIDATE

Verify all records before submitting to the Revenue Department.

e-Stamp Duty : Trust and Secure

ISO/IEC 27001 : 2022 Certified

Ginkgo Soft Co.,Ltd operates a management system in accordance with the requirement of ISO/IEC 27001 : 2022 and will be assessed for conformity within the 3 year term of validity of the certificate.

Scope

The provision of zDOX Web Application (SAAS) for content management. Including to access control to content,

The provision of getInvoice Application (SAAS) for generate e-Tax Invoice, and

The GeStamp Duty Application (SAAS) service for preparing and filing e-Stamp Duty.

TUV NORD

Beyond the basic process of submitting monetary stamp duty payments for electronic instruments (Form Or.Sor.9), GeStamp Duty provides additional features to simplify your workflow. Our team is available to assist you on any business day.